In The Star today, Dr Fong Chan Onn says we need to make the CPI more “realistic”:

MUCH has been articulated about how the Consumer Price Index (CPI) is not reflective of the purchases of ordinary Malaysians any more. This is especially true for the low to middle income wage earners, where the bulk of the population sits.

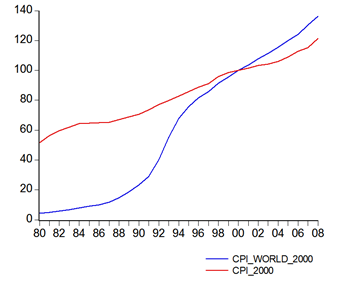

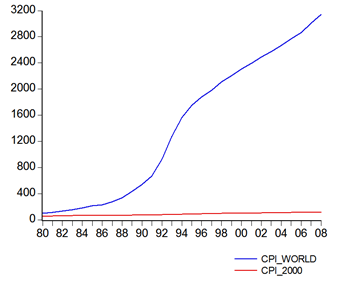

The reported CPI in Malaysia has been increasing by about 3% per annum for the last three decades, while the world CPI has gone up 3,000 times over the same period (see table on the far right). So much so that housewives scoff when they are told that prices of goods and services are only increasing at 3% a year...

...It also makes the ordinary citizens think that politicians and policy-makers are completely disconnected from the realities of Malaysian life, cocooned in making decisions that do not reflect the hardship they have to bear.

Employers and trade unions, when making yearly adjustments to wage levels, use the CPI as the basis for salary increments. Trade unions’ grouses are justified in the case of arguing that wage levels are not enough for a typical household to survive. However, they are equally frustrated with the system, as there is no other index or basis for greater wage increments...

...“Food and non-alcoholic beverages” and “Housing, water, electricity, gas and others fuels” make up over 52.8% of the weightage. Without going into the finer details of what the actual items are in these two categories, it is suffice to say that most of the items are either heavily subsidised or price controlled, like sugar, flour, water, petrol, electricity and so forth.

The dislocation in the CPI and the real prices paid by a household becomes more obvious when we consider that we do not just consume flour and sugar in its raw form, but in value-added items like cooked food and beverages. Eating out in coffee-shops or warung certainly include prepared items such as cooked fish, vegetable and prawns which are always levied at market prices but not captured in the CPI.

Transport, which makes up 15.9% of the weightage, does not take into account hire purchase for cars or motorcycles or the cost of imported spare parts for their repair.

Construction materials such as cement and clinker may be price controlled but the prices of houses and rental are determined at market rates, which are not subjected to regulations.

Mobile devices have become an integral part of our daily lives. Most of us have to pay bills for SMS, telephone calls and data download that are not included in the communication category.

The impact of an artificially low inflation rate is as follows:

> Important business decisions are based on the inflation rate, and this can mislead the private sector into making business judgments that are off the mark, costing the economy billions in losses.

> It leads to wages being artificially suppressed, creating a widening income gap between Malaysians working domestically and those working outside the country. This, in turn, exacerbates the “brain drain” problem.

> With low wages, we are not able to attract outside talent into Malaysia even though our goods and services are supposedly cheaper.

> It creates a technology gap, making Malaysia uncompetitive. Technology goods and services become expensive for Malaysians to purchase, including things like iPhones, Blackberry, and iPads which are soon becoming everyday items.

> We will have to depend on a low foreign exchange rate to ensure that Malaysian goods remain competitive but this is an unsustainable strategy in the long run.

> With a cheap currency, we cannot afford to purchase the most advanced machinery and technology, leading to poor fixed asset/capital build-up. This also explains part of the problem of sluggish private sector investments.

The implication of having an unrealistic CPI is a very serious matter and cannot be brushed aside as mere grumblings of the rakyat. However, just like in the treatment of the removal of subsidies and price controls, proper safety nets must be in place to protect the lower income and vulnerable groups.

The general price levels of the basket of goods and services will no doubt adjust itself as subsidies and controlled items are subsequently removed but this has to be done gradually to prevent hyper-inflation.

And additional items such as communication devices and computers will have to be introduced to reflect a more competitive and advanced Malaysia.

Next to the Gross Domestic Product (GDP), the CPI is probably the most important economic indicator that all governments use to gauge the health of an economy. As the CPI is the basis of many policy benchmarks with very far-reaching implications in the management of an economy and the wealth of a nation, a strong case of a more realistic mechanism for the computation of CPI is timely and much needed in an open and globally connected economy like Malaysia.

Included in the print version (not reproduced online) are a table of the CPI weights and a chart showing the different price levels as measured by the CPI of the world and Malaysia from 1980 to 2008. You can peek at the former in the May 2010 CPI report here. For the latter, no sources were listed, which is really vexing as it doesn’t allow for verification.

So I’ve done my best to reproduce it from data in the IMF World Economic Outlook database (estimated CPI levels, 1980=100):

It’s a pretty close approximation to the chart in print, and if anything shows an even greater difference between Malaysian and global inflation – the global price level in 2008 is 31.4x higher than in 1980, while the Malaysian price level is just 2.3x higher.

So that must mean that Malaysia’s CPI is a farce, right? Not so fast.

There’s a few ways to spin this. First is a presentation trick (one I was warned about while doing my Masters thesis) – change the base year, and your data plot and your appreciation of what it says will be completely different. So what happens if we change the base year to 2000, which is the current internationally accepted standard?

While the Malaysian price level is still increasing at a slower pace than the global price level, the comparison doesn’t look quite as stark.

While the Malaysian price level is still increasing at a slower pace than the global price level, the comparison doesn’t look quite as stark.

Going further back, the big jump in the global price level occurred circa 1990-1994, and began accelerating around 1988. Off the top of my head, there are three events occurring in that time span that probably boosted world inflation in general, some which impacted Malaysian inflation and some which did not:

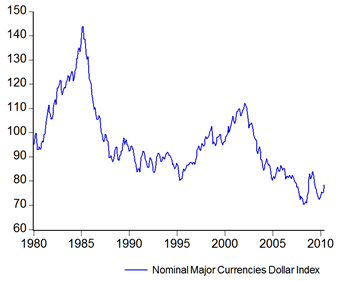

- The Plaza Accord (1985) – a coordinated action to depreciate the USD relative to global currencies. This had the effect of boosting commodity prices in USD terms for a decade, as the coordinated devaluation of the USD relative to other major currencies didn’t cease with official intervention, but continued until approximately 1995:

- The 1st Gulf War (1990-1991) – the Iraqi invasion of Kuwait in August 1990, and the subsequent US-led coalition liberation effort in Jan-Feb. Beyond the socio-political impact of the war, oil prices spiked in reaction, causing a one-time feed-through impact on consumer prices.

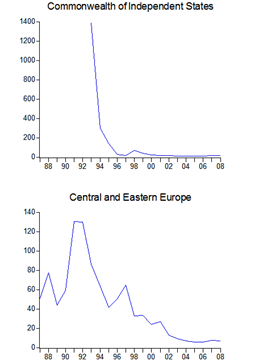

- “Shock therapy” after the collapse of USSR-led communism and the reunification of Germany (1989-1992) – The former fed incipient hyperinflation in Russia and its periphery:

… while the latter required a massive fiscal response from the ex-West Germany (inflationary) which led to a clampdown by the the Bundesbank (deflationary). On a side note, the policies followed by Germany to manage reunification led directly to the near-collapse of the European Exchange Rate Mechanism (ERM) in 1992.

Beyond these general influences, the world CPI index (at least as the IMF constructs it) is based on an arithmetic average of the percentage change in prices weighted by each country’s share of of global trade (in USD: details here).

You can see the problem here – with inflation rates as in Eastern Europe above for example, global inflation would be skewed to the high side by such luminaries of fiscal and monetary rectitude (*cough*) and relative trade heavyweights as Brazil (30-year inflation average: 380%), Argentina (300%), and Russia (17-year average: 86.5%). And then of course there’s the disaster area known as Zimbabwe, which thankfully hasn’t much of a trade presence or we’d definitely know that Malaysia’s CPI couldn’t possibly be correct.

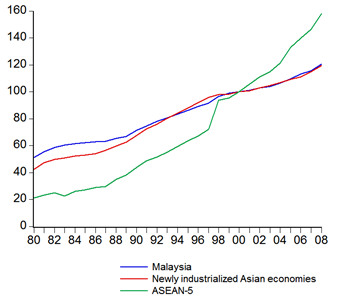

Better I think to compare with our peers, by which I mean the Tiger economies and ASEAN:

Note that our inflation experience is closest with the NIAs such as Singapore and Taiwan, whose economies we most closely resemble, than with ASEAN as a whole, mainly due to the poor inflation record of Indonesia. But that suggests either our CPI measurement isn’t too faulty, or every one of those economies has a thumb on the scales.

Note that our inflation experience is closest with the NIAs such as Singapore and Taiwan, whose economies we most closely resemble, than with ASEAN as a whole, mainly due to the poor inflation record of Indonesia. But that suggests either our CPI measurement isn’t too faulty, or every one of those economies has a thumb on the scales.

I’m not totally unsympathetic to the idea that the CPI can be improved. Certainly the faster we get rid of price controls, the more likely we will have a more accurate gauge of where prices are actually heading, not to mention remove distortions to consumption and production incentives. Nor do I totally disagree with Dr Fong’s analysis of the impact.

But the basis of comparison from which he forms his assessment is about on par with DS Idris Jala saying we’ll be bankrupt as a country by 2020 – it doesn’t hold much water, and is more a hyperbolic device than something which should be taken seriously.

Last note: I find it ironic that some of the products that are suggested to be included in the CPI would have a disinflationary impact. Both mobile devices and data charges have generally been falling, as have prices of computing equipment.

Noting this blog post, as well as you post: "Measuring Inflation", 17th June, 2010, I feel that you have not addressed the common theme in the two newspaper articles which your posts responded to.

ReplyDeleteThese news articles, as far as I understand them, suggest that the basket of goods that constitute the CPI is partly made up of controlled items. These items cause the CPI to increase at a low rate.

What are your comment on this specific point: should, or shouldn't the prices of these items be uncontrolled in order that the CPI reflect the true cost?

Note: Also take into account (and before you tell me that the citizen do actually purchase these items at the controlled prices) that many downstream products that use the controlled items are themselves not controlled. For example, rice might be controlled, but nasi goreng ayam at the stall definitely is not.

Many thanks.

Sorry: for the phrase... "in order that the CPI reflect the true cost?", please read ..."in order that the CPI better reflect the 'true' inflation".

ReplyDeleteHi,

ReplyDeleteYou raise good points. First, to me, whether prices are controlled or not is frankly irrelevant - under both circumstances, from a strictly technical perspective, you will get the "true" rate of inflation i.e. the general increase in the price level.

The distortionary impact of controlled prices turns up in other areas, chiefly in higher propensity to consume and reducing the incentive to produce. I firmly believe price controls have played a major role in stunting the development of food agriculture in Malaysia. You can read even more about that here.

I think what people are experiencing in terms of higher prices is really a factor of noticing price changes in what we spend on the most, and also most frequently - food and transport. You'll get further details here. That gives an alternate index composed of the more volatile components of the CPI.

Hope not too late to comment here. My monthly income in the past 3-4 months nowadays barely pay my households items already. I have started doing the cost cutting measures to fit the income (which has not been raised since last year). Imagine majority of Malaysian doing these. Just as of today my wife was shocked that the cocoa butter she used to buy at RM3.90 last month now cost RM4.70, a whopping 24% increase. I don't think 3% inflation rate is accurate in this instances. Thanks

ReplyDeleteAzizul, people's experience of inflation depends on their particular circumstances. If you have a high percentage of expenditure on food items, then inflation might seem higher than the official rate - which is an average over a wide range of goods and services. If food on the other hand is a low portion of income, then inflation might seem lower than the official rate.

ReplyDeleteYou might be interested in the alternate index I linked to in the post above yours.