Maybe Bank Negara was right after all. Anecdotal evidence suggests price increases in housing are accelerating:

Welcome to a speculator’s market - THEAN LEE CHENG

SINCE the last quarter of 2009, property prices have not gone up incrementally. They have escalated, especially for landed units. In certain locations, prices may be unsustainable.

Up to the first quarter of this year, intermediate two-storey houses in a popular part of Petaling Jaya were transacting at about RM650,000.

Yesterday morning, an agent said the company had sold several houses facing T-junctions (which are not popular units among buyers) in the same township. These were 2 1/2-storey houses. One was sold for slightly more than RM1mil, among the highest he has ever seen in that location for a house located opposite a T-junction while another was sold for RM950,000, the lowest among the three.

I’ve previously been dubious about the potential of a housing market bubble in Malaysia, for various reasons, not least of which that house prices up to 4Q2009 have been fairly stable. Apparently, the jump in prices started in 2Q2010, which we won’t see in the Malaysia House Price Index until a few months from now – which is a real good argument for a higher frequency (the MHPI is only reported quarterly) and more timely reporting (the lag is a full quarter) of housing transaction prices.

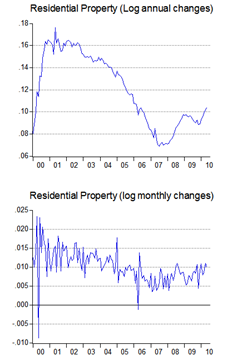

On the other hand, residential housing loans aren’t showing higher than average growth, certainly not as much as the go-go days of in the early part of the decade (log annual and monthly changes; 2000:1-2010:6):

That suggests that speculative activity is limited, and only in certain spots of the country, particularly in the Klang Valley and Penang. I’m not discounting that there isn’t a property bubble forming, but I do think that the risk to the financial system and the economy when the bubble pops is limited – which is the important thing.

No comments:

Post a Comment