Today’s industrial production report was a mixed bag. On the month, the unadjusted series fell 0.8% in log terms (up 5.4% y-o-y), but taking into account the Ramadhan effect, the IPI rose – just barely – for the first time in four months (log annual and monthly changes; seasonally adjusted):

I’d be more optimistic though if the growth wasn’t being driven by the mining index, which is always volatile. Hence I’m reluctant to call this a sign of better things to come, even if I’m expecting a bump up in output in October due to the upcoming holiday season.

The drop in electricity usage is especially worrying, as it signifies not just lower production but also lower private demand.

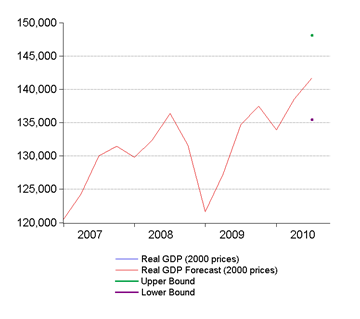

That’s underscored by the 3Q GDP forecast implied by the IPI – it ain’t pretty, and is actually somewhat worse than the one I did last month week based on the trade numbers:

Point Forecast: RM141,751.8

Range Forecast:RM147,946-RM135,557.7

The point estimate gives a y-o-y growth rate of 5.2% (5.7% based on the trade numbers) and –3.1% q-o-q; sa; annualised (0.0%).

The truth is probably somewhere in between, but there’s no denying that this past quarter hasn’t been exactly great. The only saving grace is 3Q data on consumer spending (e.g. auto sales) which suggest that consumption demand is not in sync with actual production, plus rising house prices which would be incorporated into the GDP estimates. As against that, you have to count the drop in electricity demand – so I’d call that a wash.

Technical Notes:

September 2010 Industrial Production Index Report from the Department of Statistics

No comments:

Post a Comment