Fun, fun, fun. Just like with the CPI, the Department of Statistics has revised the basis of the leading, coincident and lagging economic indicators. The good news is that they’ve rather nicely recalculated the time series for all three based on the new components, and added diffusion indexes. The bad news is that this means a lot of input work for me.

So you’ll just have to read their own take on it, for now.

I’d also call attention to the reference dates for Malaysia’s business cycle, which have been included in the report for the first time. I can’t say enough how important this little nugget is, because it gives researchers and econometricians looking at Malaysia a single point of reference when looking at growth and recession periods, much like the NBER Business Cycle Dating Committee does for the US (note: the term recession here has a different meaning from what it’s usually taken to mean).

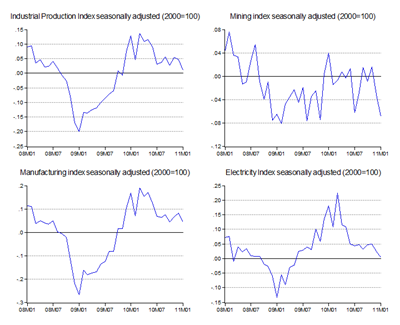

You can find the dates at the end of the full report (warning: pdf link), along with information on the construction of the new indices, which are interesting in and of themselves. The fact that seasonal adjustment and HP filters were used (hopefully with the correct cycle parameter), shows DOS are getting confident in their use of best practices. I would have also wished that some of the component indices were also published, like the Retail Sales Index and especially Manufacturing Capacity Utilisation, but beggars can’t be choosers.

Technical Notes:

January 2011 Economic Indicators Report from the Department of Statistics