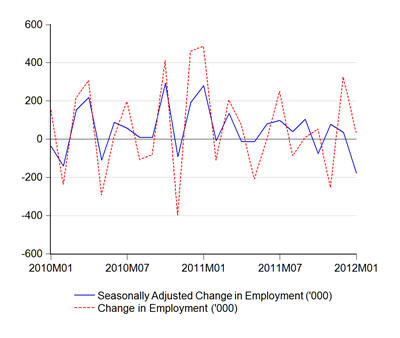

The seasonal adjustment revolution marches on. This time, the employment numbers get the treatment, though sadly, they don’t go back through the whole available series, nor has DOS provided anything more than the unemployment rate itself. I suppose beggars can’t be choosers though.

In any case, employment increased marginally in January (remember, it’s CNY):

My own seasonal adjustment suggests that employment growth probably should have been a lot higher (about 177k more), but data for this January is so skewed this year, I have trouble believing in any of it.

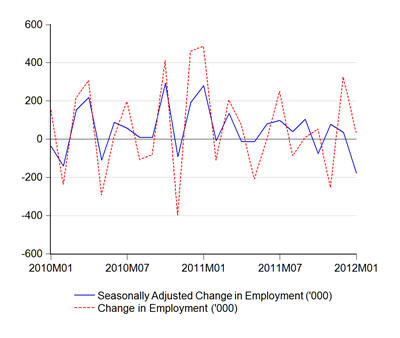

The unemployment rate has dropped again, though the new seasonally adjusted DOS figures show a sharp drop:

Comparing the series, it seems as if DOS’ series is a lot more volatile. Be that as it may, all three series are turning down. Coupled with my reading of the remarks at yesterday’s analysts’ briefing with BNM yesterday, I think what we have here is an economy that’s heating up ever so slightly. I thought core inflation was on the high side last year, and it seemed as if it came from more than just the pass through of prices from the supply side. This year looks like more of the same, though we’ve got far more investment projects coming on stream, and growth is already back on its long term trend.

I’m not about to call BNM hawkish, but if there is any bias towards monetary policy this year, I suspect it will increasingly be towards raising interest rates.

Technical Notes:

January 2012 Employment Report from the Department of Statistics (warning: pdf link)