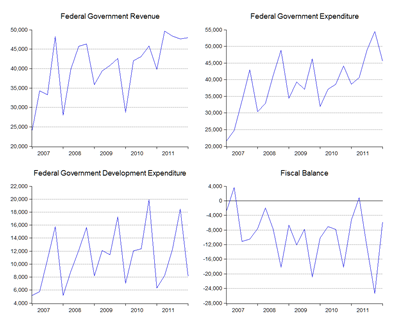

The 1Q2012 numbers for the government’s accounts were published along with the April 2012 Monthly Statistical Bulletin from BNM. There’s some good and bad points, but the general tenor is that there’s been some improvement in the government’s overall fiscal position (RM millions):

The raw numbers show the typical seasonal nature of government spending, essentially tied to the ebb and flow of tax receipts. Revenue was flat between 1Q2012 and 4Q2011, which is a minor miracle and indicates that revenue for this year should well exceed last year’s budget forecast. Expenditure in both operating and development categories fell, although we’re still looking at a deficit of around RM5.8 billion.

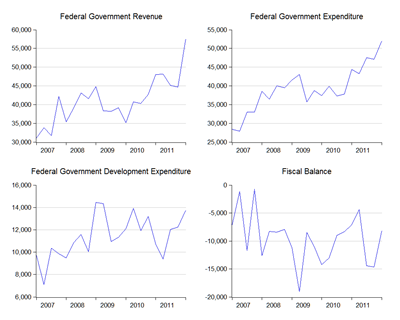

Seasonal adjustment shows by just how positive these numbers actually are (RM millions; seasonally adjusted):

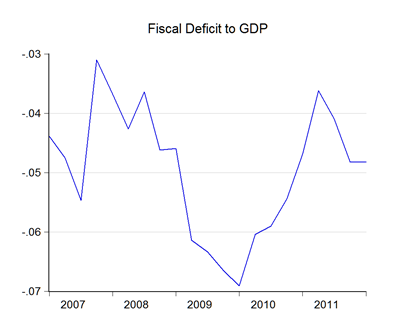

The deficit’s still somewhat bigger than the same quarter last year, but we’re also dealing with a bigger economy this year:

The ratio is a hair under 5%, and not quite where we’d like it to be, but I’d be looking for some improvement over the next couple of quarters as this year’s tax collection starts coming in.

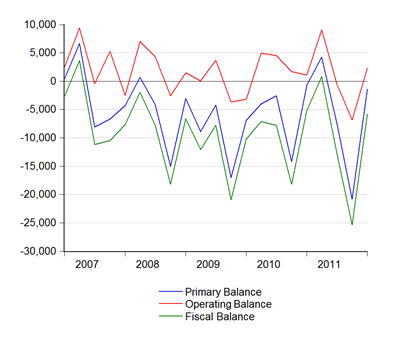

Looking deeper into the deficit position, I’ve superimposed three different budget balance definitions in a single chart (RM millions):

The fiscal balance is the overall surplus/deficit, the primary balance is the fiscal balance less debt service charges, while the operating balance includes debt services but excludes development expenditure. By law, the government has to maintain a surplus on the operating balance on an annual basis – there’s only been an annual deficit in three out of the last 40 years, and none since 1987.

However, the general recommendation from multilateral institutions such as the IMF is to attain a balance on the primary balance. We’ve still a ways to go there, if you believe balanced budgets matter (and I don’t).

I’ll deal with the government debt position in the next post, but I want to include two other interesting charts that I don’t think I’ve ever included before.

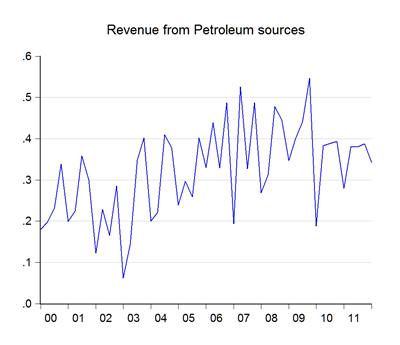

First, revenue from petroleum sources as a ratio to government revenue over the past decade (dividends, petroleum royalties, petroleum income taxes):

The chart probably overstates the case a bit, because I haven’t disentangled Petronas’ dividend payments from the return on other equity investments. Nevertheless, the share is still pretty high over the past year at over 35% but its no longer quite the 40% that Petronas and others claim. I’d expect to see the ratio coming down a bit this year based on the expected reduction in the Petronas dividend.

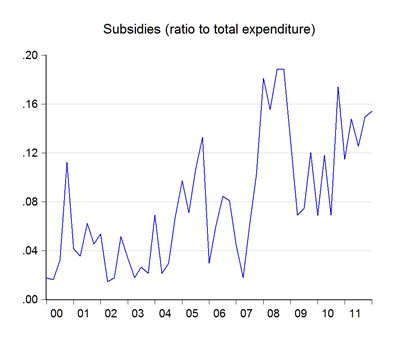

Second, here’s the ratio of subsidies to government expenditure:

Currently about 14% of government expenditure goes towards subsidies of various kinds, of which about half would be for petrol. This however doesn’t include the subsidies on natural gas that are paid for directly by Petronas, which would almost double the subsidies spent on fuel if they were on the government books. Again, this is something I expect to climb down a little in the next few months with the softening in global crude prices. An opportunity to restart subsidy rationalisation, methinks, if the general election’s called soon enough.

Technical Notes:

Federal Government revenue and expenditure data from the April 2012 Monthly Statistical Bulletin published by Bank Negara Malaysia

No comments:

Post a Comment