These guys have waaaay too much time on their hands (excerpt):

World Cup 2014 Special

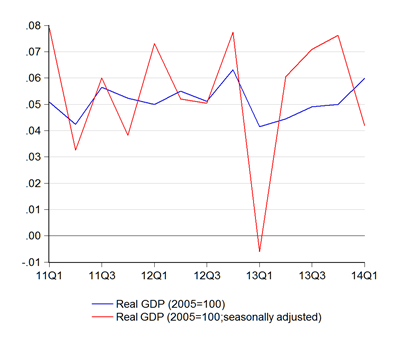

Brazil set to succeed on the pitch …but it’s an uphill battle for the economyWhile there is not much to cheer about regarding the Brazilian economy, we believe the Brazilian population will at least be able to cheer about its national team’s result at the upcoming football World Cup.

In this document, we present our forecasts not only for the Brazilian economy but also for the outcome of the World Cup. We have estimated an econometric model for the World Cup result based on data from the five previous World Cup tournaments and used the model parameters to simulate the upcoming World Cup and the results are clear to us.

In our view, home advantage, a large population and a strong football tradition will ensure that Brazil wins the World Cup. We believe Argentina will be in the running but will lose to Brazil in the final. Germany will take third place.

However, chance is a major factor in football, so nothing is given – not even for Brazil. To describe these factors we have used so-called Monte Carlo simulations to estimate the probability of different teams winning the World Cup. Brazil is strong favourite, with our simulation indicating a 45% chance that Brazil will win the tournament. We calculate the runners up are much less likely to win, with Argentina having an 8.1% chance, Germany 7.6% and France 6.7%.

[H/T Lars Christensen]