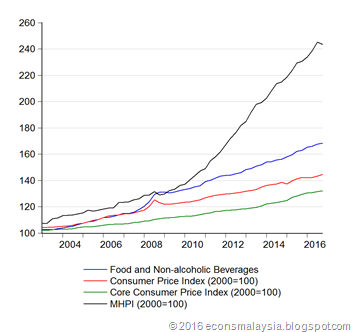

I was struck by a graph I saw the other day, and I’ve tried to reproduce it here. This is the still relatively new Core Inflation Index from DOSM (index numbers, log annual changes; 2010=100):

The graph of the growth (inflation) of the index is truncated because that’s more or less what’s publicly available, but trust me that the longer series shows core inflation at roughly 2% for the two years prior.

This shows very, very clearly the impact of GST, and fulfills the prediction I made nearly four years ago – GST caused an upward shift in the price level, but didn’t cause inflation (as narrowly defined by economists) to rise. It was purely a price level change, and didn’t change the slope of the index. The impact appears to be a roughly 1.8% peak to trough increase in the price level, in line with the MOF/BNM forecast.

Core inflation is currently appearing to accelerate, but that can’t be ascribed to the imposition of GST, which after all happened exactly two years ago.

Technical Notes:

Data from various Consumer Price Inflation reports from the Department of Statistics. NOTE: DOSM’s core inflation index excludes both highly volatile prices (certain seasonal foods such as vegetables) as well as petrol prices (which have been very volatile since the float in 2014). It also excludes prices of goods that are “administered” i.e. those whose prices are either fixed by the government (e.g. rice), or move due to changes in government tax policies (e.g. tobacco and alcohol). Therefore a presents a truer picture of underlying price pressures in the economy. Note that this doesn’t mean stuff doesn’t get more expensive, it just takes away the volatility in inflation, which makes it more useful for policymakers such as BNM.