The NEER and REER page has been updated, as has the Google Docs version.

Summary

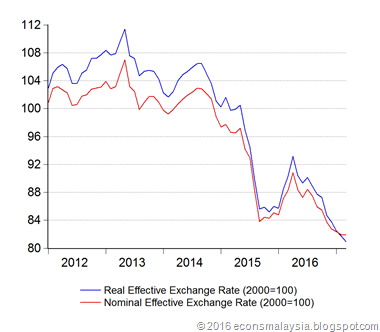

MYR is losing out on the emerging market rally. Both indexes continued to decline, despite stability against the USD. There was a slight uptick in the Nominal Narrow Index (top 5 trading partners), but the Real Narrow Index dropped 0.26%, as inflation accelerated faster in Malaysia. The Real ASEAN index dropped the most month on month (-0.76%), but having said that, March marks the first time this particular index has dropped below 100 since June 2000.

Despite this, on a bilateral basis, MYR appears to have turned around, or at least stopped losing ground. Gains were recorded aganst 9 out of the 15 currencies in the broad basket. The nine-month losing streak against the AUD finally ended (+0.65%), with the biggest gain coming against the GBP (+1.31%). The biggest drop was against the INR (-1.65%), followed by the TWD (-0.61%) and KRW (-0.58%).

One last thing: The indexes have crossed, with the NEER now above the REER. This is largely due to inflation in Malaysia accelerating faster than our peers. Technically, if you believe this stuff, that indicates the MYR is now overvalued, though I’d reserve judgement until I get a chance to take into account nominal interest rates as well (standard UIP model).

Changelog:

- Indexes have been updated to March 2017

- CPI deflators and forecasts have been updated for February/March 2017

I read with interest Nor Zahidi Alias article in The Edge about short term papers and long-term papers, could the NEER/REER issue caused by this selling of short-term paper?

ReplyDelete@Zuo De

DeleteIt's really the other way around. It's the selloff in the bond market (and the reluctance of foreign bond investors to come back in) that's keeping the Ringgit depressed.